Get Flood Insurance Illinois & Save Money Too.

People in Illinois save on average $500 to $1,457+ on their annual flood premiums.

In many cases, we save them even more. Get the cheapest flood insurance in Illinois without sacrificing coverage.

Get flood insurance from a Flood Nerd® at Better Flood Insurance® and save big time.

featured on

Quick Guide to Illinois Flood Insurance

How much is flood insurance in Illinois?

Get Cheap Flood Insurance without Compromising Coverage

Affordable Coverage

★★★★★

"Same Coverage at a Better Rate"

-Mohammed K

Flood Nerds will shop the private flood insurance markets and then compare them to the NFIP, guaranteeing you the better option. We will send you the cheapest flood insurance rates within minutes.

Quick Quote & Coverage

★★★★★

"Quick Response, Very Knowledgable"

– Robert W

Paying for low-cost flood insurance is awesome. And letting the Flood Nerds shop your property has other benefits – you can get better coverage while saving money, and you can get it fast.

We Have Satisfied Clients

★★★★★

"Would highly recommend Better Flood for your flood insurance needs."

– Varun K

Better Flood Insurance is an independent flood insurance broker that shops flood insurance ONLY. Flood Nerds are Flood insurance experts. We have 5000+ happy clients and 390+ 5-star reviews.

Does my Illinois homeowner insurance cover flooding?

A typical Illinois homeowners’ policy is written through Farmers, State Farm, Allstate, and Progressive, for instance, excludes flooding as something that will be covered under their homeowner’s policy.

In most cases, the only way to get flood coverage is by purchasing a stand-alone flood insurance policy. However, you should ask your homeowners agent if you can add an endorsement to your homeowner’s policy to cover flooding. Yet, don’t be too surprised if the answer is NO.

Do I need flood insurance in Illinois?

It is important to have flood insurance coverage in Illinois because our beloved Cowboy State has seen a fair share of flooding, and more is likely coming.

We believe that most homeowners think about Flood insurance in Illinois at some point, maybe before buying a home or during the closing process. Many of us only think about flooding when a big storm is threatened.

If your home or business is in a flood zone, that is considered a low flood risk area. Sadly, many homeowners decide to forgo purchasing coverage because they believe they are safe from flooding. Some real estate and insurance agents may even say you don’t need it.

I ask you to consider the facts: 20 percent of all flooding events across our nation come in areas that are considered low risk. After our last few major storms (Hurricane Harvey), we saw flooding in these low-risk areas. 80Eighty percent of these individuals had water in their homes or buildings and didn’t have flood insurance coverage.

In Harris county, nearly 135,000 homes were damaged. Three-fourths of these properties were considered low to moderate risk.

We often hear that people believe the government will help, which is true. However, a few things must align for you to get government assistance.

1. The president of the United States must declare the flooding event a state of emergency. If this doesn’t happen, then there won’t be assistance.

2. The average amount of assistance homeowners get after a flood when they do not have flood coverage is $5,000. The average cost of damage to one’s property after a flood is $38,000+. That $5K you get from the government? It comes as a loan, and you will need to pay it back. Are you willing to gamble on your financial future by forgoing flood insurance coverage?

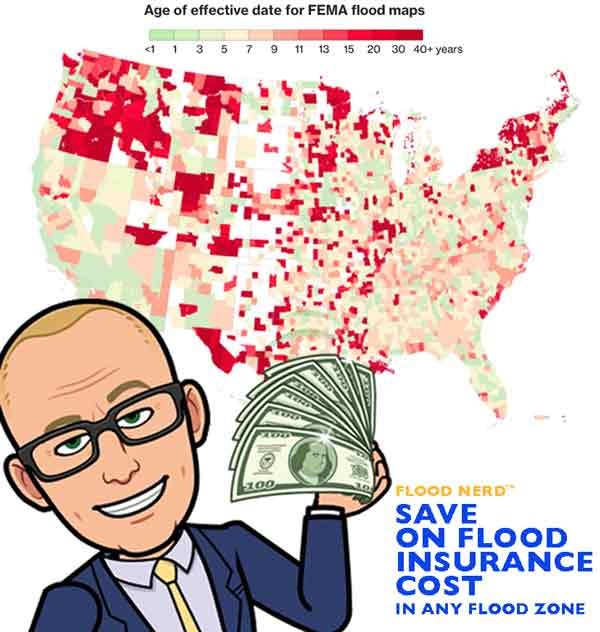

One more note on these low-risk flood zone maps. Many of these maps are over 40 years old. If the area has been developed, there is likely more concrete, creating a barrier for land that previously might have absorbed the massive downpour.

Because of all these factors, it is difficult for property owners to know their true risk of flooding. FEMA admits that their flood maps only give an idea of part of the risk. Our recent storms are facts that it can rain anywhere within Illinois, and you should consider getting flood coverage so you are not uninsured when you need it most.

FEMA flood zone maps often take years to go into effect after the terrain was studied; this gives the impression that the area is “more up to date” than it is.

The average cost for Illinois flood insurance in these Low-risk areas is $595 per year.

FEMA’s National Flood Insurance Program (NFIP) and all federally backed lenders rely on these Illinois flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Bad information about an area’s flood risk can leave property owners under or uninsured.

Illinois NFIP flood insurance.

Illinois has many options regarding flood insurance, but they fall into two main categories. The Government policy (called NFIP or FEMA) and Private flood insurance

The National Flood Insurance Program (NFIP), also known as FEMA, is the government option for flood insurance. The NFIP has enjoyed a 50-state monopoly on the flood insurance market.

Not “private flood insurance” but NFIP Resellers

Suppose you have Nationwide Flood Insurance, State Farm Flood Insurance, Progressive Flood Insurance, or any of the logos below. In that case, you are buying the NFIP flood policy that is just being resold through a government program. These companies are private companies, but their flood insurance is not. Here is a list of the 70 companies that resell the NFIP policy.

Illinois private flood insurance market

Cheap flood insurance in Illinois

There are alternatives to NFIP or government insurance. It is called Private flood insurance, most notably Lloyd’s of London Flood insurance. However, there are other options available in Illinois. We shop all the options for your property in your region to ensure you are getting the best premium. Please click here if you are ready to have us do the work for you.

Our shopping includes the NFIP because sometimes we find that you can get a much better premium with government subsidies.

Flood insurance quote Illinois

Lloyd’s of London Flood Insurance Illinois Market

Illinois is fortunate to have many Lloyd’s of London flood insurance options. Although many Lloyd’s flood insurance companies will have you assume that there is only one option, nothing could be further from the truth.

Lloyd’s of London has a rich history attributed to having invented the first modern insurance model. Unlike most of its competition, Lloyd’s of London is not a company but a corporate body. This structure works well since it has been around for over 330 years. Lloyd’s operates under multiple financial backers pooling their capital to spread the risk.

I have two blog posts that deep dive into Lloyds of London and what they mean to Illinois’s flood insurance market. If you are interested, the links are below.

Illinois Lloyd’s of London Flood Insurance

FEMA vs. Private flood insurance

Lloyd’s also ensures the world for flood insurance, meaning they cover flooding events in India, Australia, and much of Europe. The “game” of insurance is to spread your risk since Lloyd’s is worldwide.

My joke here is that Lloyds is banking on God’s promise that he won’t flood the entire world again, so they won’t have to pay out the whole world’s flood claim.

How much does flood insurance cost in Illinois?

Many factors go into getting the cost of flood insurance for Illinois. If your home is in what is considered a low-to-moderate risk, you can get a heavily subsidized policy through the government.

Illinois flood insurance low-to Moderate Risk rate and cost.

This is Flood Zone X, which is not lender required flood zone.

This is usually identified as an X-flood zone. Then we would suggest the government Preferred Risk Policy (PRP) which is a subsidized policy and has set flood insurance coverage limits (see the grid below):

NFIP Maximum Coverage Limits

NFIP Maximum Coverage Limits

Here is a link if you want to dig into this one. Be ready for an eye chart because every option is a public record and should be standardized to accost whoever writes these policies.

The average cost for flood insurance in Illinois with the maximum set limits in these Low-risk flood zone areas is $405 – $700 per year.

Your property is in a higher-risk flood zone, usually identified with a Flood Zone AE. Your lender will require you to have flood insurance. The cost of flood insurance in Illinois depends on many factors unique to the structure. We will try to give you an idea of the most common homes we see in Illinois with a basement foundation.

We will look at the Illinois cost of flood insurance for the NFIP maximum of $250,000 for the (building only) with NO CONTENTS and our recommended deductible of $5,000.

We will be rating this example on the NFIP and a few of our private flood insurance policies, specifically Lloyds flood insurance options in Illinois.

Cost of Flood Insurance in ILLINOIS in high-risk flood zone AE

Our example is in Chicago, but the premiums will be the same in Bellwood, Des Plaines, Prospect Heights, Will, and many other Illinois flood ones.

In our example, the Base Flood Elevation (BFE is 642) and is a home that is built before 1973

NFIP option in Illinois Flood Zone AE

NFIP – Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

NFIP Annual premium in High-Risk flood zone is $6,861.00

This option is what we see if the property has had a flood loss before and either doesn’t have an Elevation Certificate applied or the Elevation certificate showing that the lowest floor is 4 feet under the BFE for the area. You can use 10% of your coverage to cover other structures on your property.

Illinois Private flood insurance – Lloyd’s of London Flood Insurance (option 1)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyds of London (option 1) Annual premium in High-Risk flood zone is $937.00

This option is great, and we are very happy when we can get this option. They can be a bit choosey about what risk they will accept and will not take anything that has had a flood loss. They offer basements coverage, about $2,000 for loss of use and $2,000 for other structures, but they can’t increase this coverage. They do not require an Elevation Certificate to rate.

Illinois Private flood insurance – Lloyd’s of London Flood Insurance (option 2)

Coverage of $250,000 building coverage (no Contents coverage) and $5,000 deductible

Lloyd’s of London (option 2) Annual premium in High-Risk flood zone is $1,126.00

This option is great, and we are very happy when we can get this option for our clients. They seem to be writing almost all risks; however, they do not write any property in a designated floodway or has a depth of -4 under the BFE. In our example, with our BFE being 642, they will not accept this risk if the lowest floor is 638. They will not take anything that has had a flood loss. They offer limited coverage for basements and do not require an Elevation Certificate to rate and as a percentage of coverage for loss of use. If you want coverage for other structures, that will need to be added.